Women Helping Women Out of Poverty—One Business at a Time

Financing for entrepreneurs in the Kyrgyz Republic offers financial stability to households and is starting to reshape the country’s economy.

At 2 a.m. in the quiet streets of Balykchy, a small town in the Kyrgyz Republic, most people are deep in the embrace of their dreams.

But for Altynai Arzymatova, a 34-year-old single mother of three, the day is already getting started.

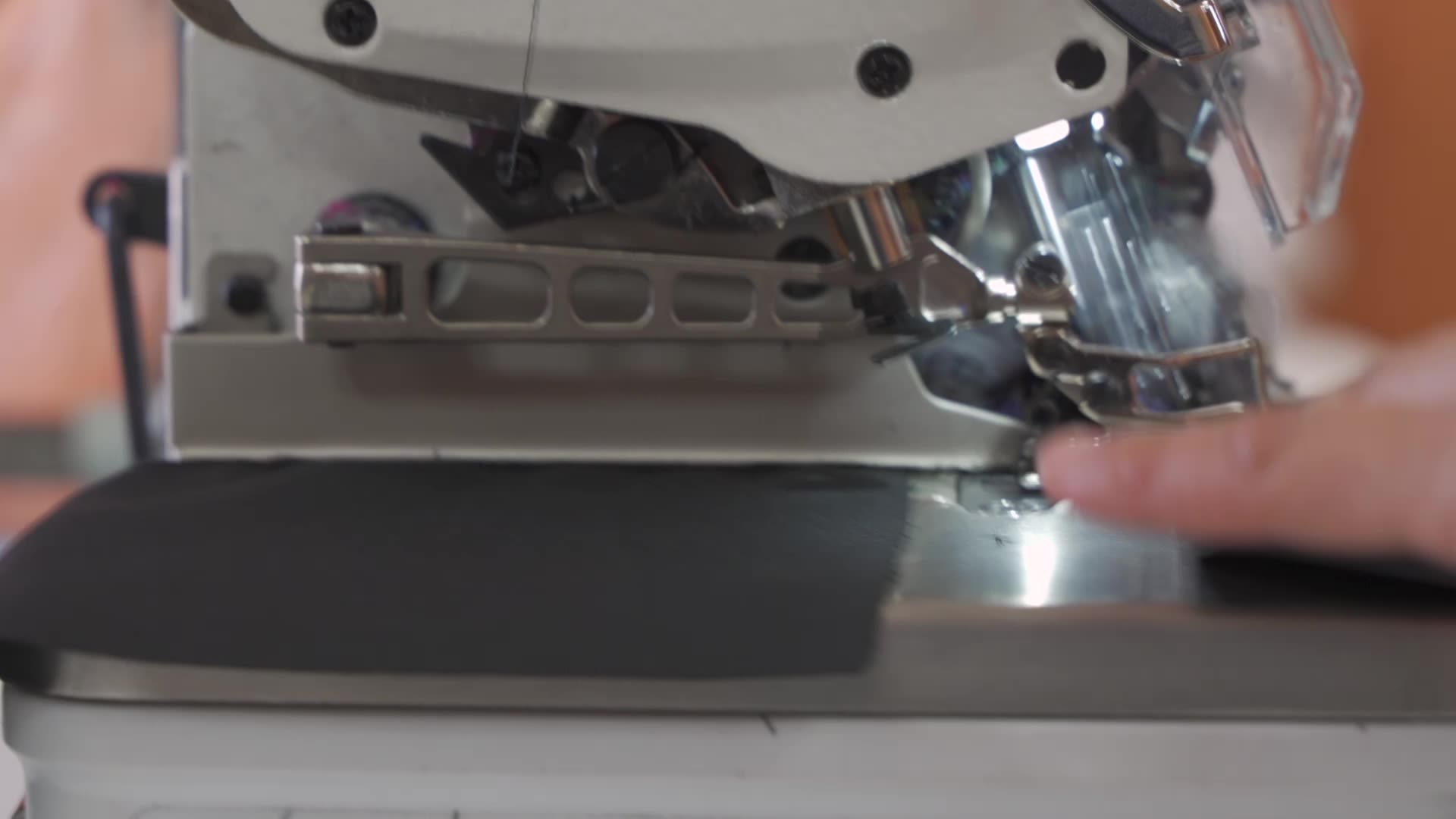

Arzymatova owns a busy sewing shop in town. Though it’s still dark, she starts organizing orders and materials so that everything is ready for her team of workers when they walk in the door. After this pre-dawn flurry of activity, Arzymatova allows herself a brief break from 5 a.m. to 8 a.m., preparing for the full day that lies ahead.

She has maintained this schedule since 2019, when she received a 100,000 KGS ($1,127) loan from Bailyk Finance. Back then, she owned just three sewing machines, but now she owns 20, and employs 15 workers. “I am very grateful for Bailyk Finance,” says Arzymatova. “With their support, I was able to establish my own shop to be financially stable and also spend more time with my children.”

Ownership of the shop—a converted shipping-container in a long row of other shops just like it—has changed her life. Prior to opening her own business, Arzymatova worked at a sewing shop in Bishkek, the capital, while her young children remained with relatives in her small town. Every Saturday, she traveled for hours to spend the night with her children, savoring the time until her departure the very next day. After a serious car accident and long convalescence, Arzymatova decided she needed to spend more time with her children—so she moved back to Balykchy and applied for a loan to launch her own business.

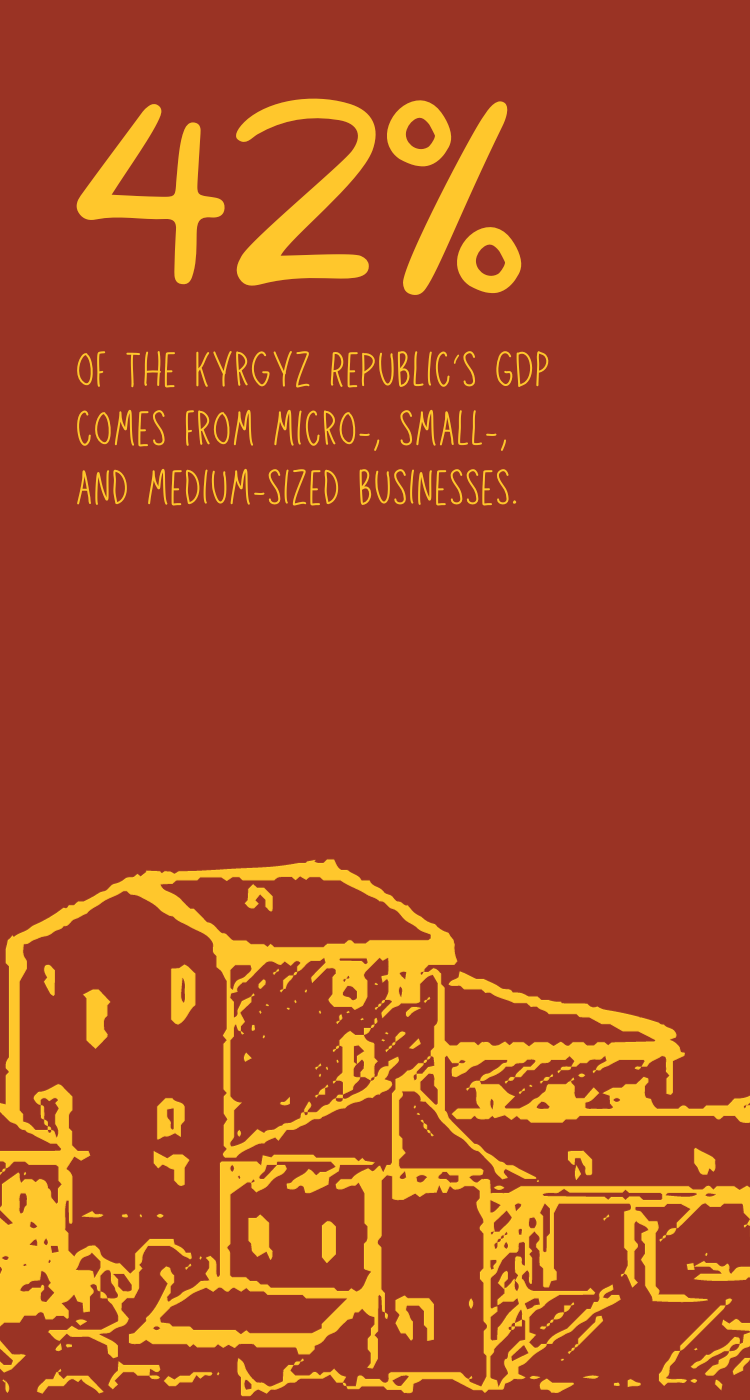

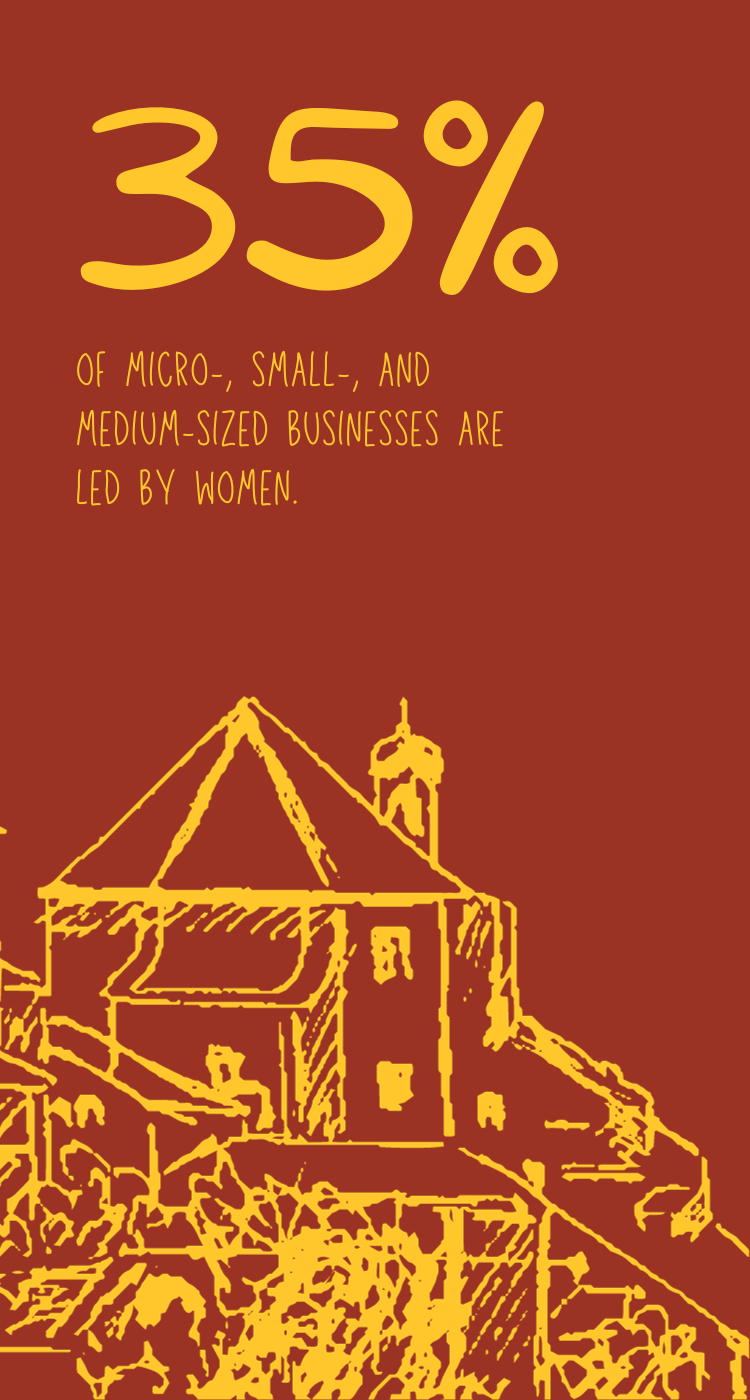

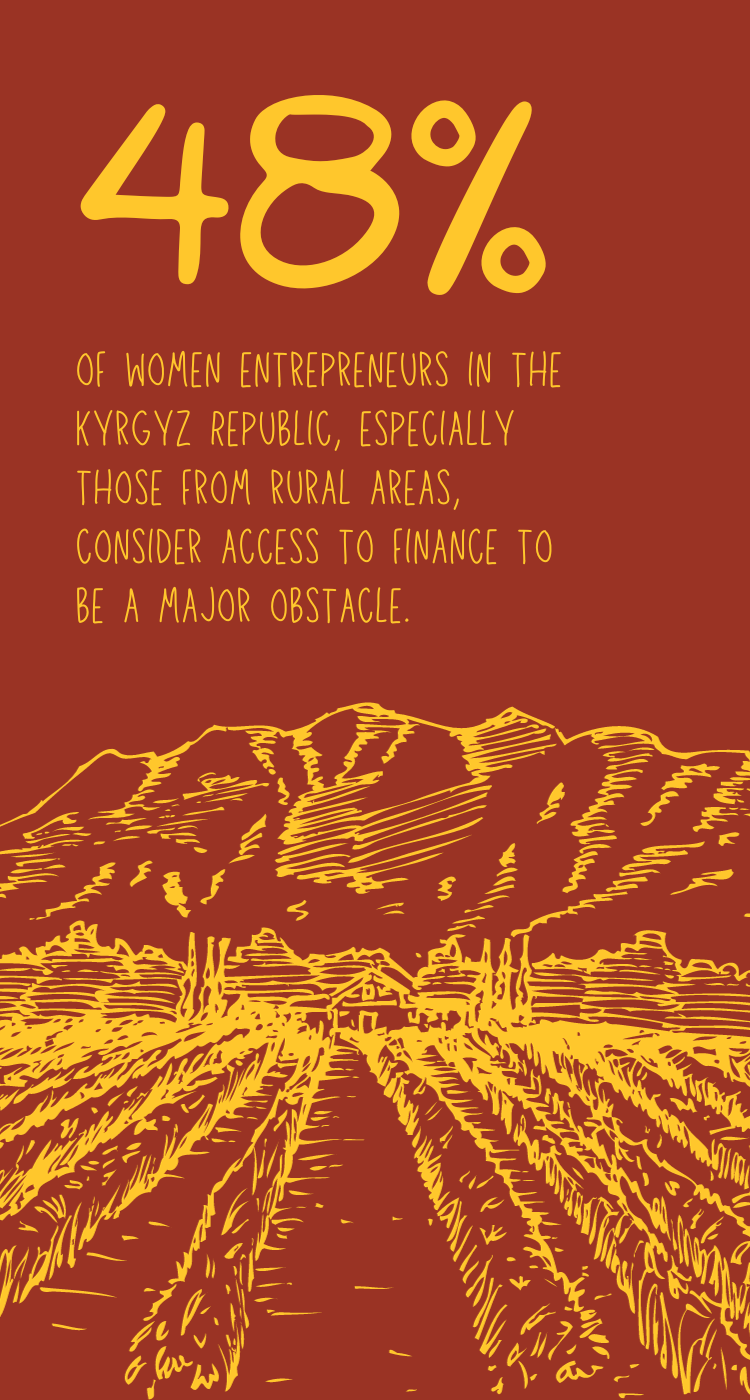

It was no simple task. Tradition dictates that women in the Kyrgyz Republic remain within the household rather than seek outside jobs, so they have little land and property of their own. As a result, it’s difficult for them to access finance due to insufficient collateral, weak credit histories, and perceived high credit risks. Though micro-, small-, and medium-sized enterprises (MSMEs) play a central role in the country—contributing to 42 percent of the country’s GDP—women-led MSMEs account for just 35 percent of MSMEs. Forty-eight percent of women entrepreneurs in the Kyrgyz Republic, especially those from rural areas, consider access to finance to be a major obstacle to opening and running a business.

“Few financial institutions recognize the untapped potential of women entrepreneurs in our country,” says Chinara Moldozhanova, CEO of Bailyk Finance, the bank that granted Arzymatova’s loan. “Kyrgyz women demonstrate exceptional financial acumen, directing their earnings towards the family’s well-being. We prioritize financing women, because women are responsible and always repay the loan on time.”

Chinara Moldozhanova, CEO of Bailyk Finance, inside her office.

Chinara Moldozhanova, CEO of Bailyk Finance, inside her office.

“I am very grateful for Bailyk Finance. With their support, I was able to establish my own shop to be financially stable and also spend more time with my children.”

Tailoring banking services to women entrepreneurs

New policies from microfinance institutions (MFIs) like Bailyk Finance are building on this belief and helping women entrepreneurs succeed.

Bailyk Finance, founded in 2011, is the third-largest MFI in the Kyrgyz Republic. Ninety-four percent of its 50 offices are strategically located in remote regions to respond to the financial needs of MSMEs.

MFIs like Bailyk Finance are responding to a substantial untapped commercial opportunity in the Kyrgyz Republic. IFC research shows that financial institutions could see a 638 percent growth in annual revenues from $67.6 million to $431.5 million by adopting a dedicated approach to the women’s market. This approach should entail understanding and addressing the unique needs and constraints of women entrepreneurs, creating a more inclusive and innovative service model, according to Ceren Ozhan, an IFC Investment Officer working with financial institutions in Central Asia.

Across Central Asia, IFC has been ramping up its work to expand financial services and market access for women-led businesses. Since 2018, IFC has invested $155 million in 15 local financial institutions across the region.

Bailyk Finance, an IFC partner, has taken a proactive approach to develop specialized programs tailored to the unique needs of women-led MSMEs. These programs are supported by the IFC Central Asia Banking on Women advisory project. In addition to financial support, Bailyk Finance provides mentorship to women clients. One particular area of focus is women entrepreneurs in the garment industry. That’s because the number of clients in the garment industry has increased “as our products satisfy their needs and the process is easy,” says Moldozhanova.

Confronting poverty with private sector solutions

Financing for MSMEs—and strengthening the private sector overall—is more important than ever in the Kyrgyz Republic. That’s because the pandemic inflicted a severe blow to economic growth: In 2020, the country’s GDP contracted by 8.4 percent. The poverty rate surged from 16.2 percent in 2020 to 18.3 percent in 2021. Rural areas, which are home to 63 percent of the country’s population, have suffered the most. The Kyrgyz economy has so far proved more resilient than expected to the spillover effects from Russia’s invasion of Ukraine. The World Bank estimates the country’s GDP growth for 2023 is expected to moderate to 3.5 percent.

The potential of women entrepreneurs to help drive economic recovery is strong, according to Nurzhan Azimova, Executive Director of the Women's Forum Kurak. “Women have the capacity, the knowledge, and skill set required to open and manage businesses,” she says. “They have a profound desire, despite barriers such as access to finance.”

Nurzhan Azimova, Executive Director of the Women's Forum Kurak.

Nurzhan Azimova, Executive Director of the Women's Forum Kurak.

Local associations such as Kurak educate women on their financial options, mentor women entrepreneurs nourishing ideas, and offer trainings on how to operate a business. “We cover all sectors of the economy, with a particular emphasis on empowering women in rural regions,” says Azimova. “If women have more knowledge, I believe they can effectively monetize their skills and achieve success in business.”

Reimagining financing

Nazgul Attokurova and her husband have always wanted to open their own business and use the income to invest in their children’s future. The couple, who worked at a French bakery in Russia for five years, now run a home-based bakery that sells traditional sweets in Archa-Beshik neighborhood of southwest of the capital. They launched the business with their personal savings and then approached Elet-Capital for a loan of 1 million KGS ($11,313).

Korzhik, a popular local biscuit cookie.

Korzhik, a popular local biscuit cookie.

After purchasing additional baking equipment, they are preparing to expand by offering croissants—her husband’s specialty. They also plan to apply for a patent to protect their business. With a view to tapping into larger markets, Attokurova and her husband have their sights set on establishing a wholesale venture with prominent supermarket chains, including Globus, one of the country's most prominent retailers.

“We are grateful for the loan by Elet-Capital, which enabled us to establish our business,” says Attokurova. “Without this business, we would have to remain migrants in Russia. But now we remain in our homeland and build a future with our children by our side.”

A drawing created by Nazgul Attokurova's daughter.

A drawing from Nazgul Attokurova's daughter using coffee beans.

Workers at Gulbaira Botaliyeva's carwash shop.

Workers at Gulbaira Botaliyeva's carwash shop.

Other women entrepreneurs are equally focused on growth. Gulbaira Botaliyeva got a taste for business when, with personal savings, she opened a home-based sewing shop that started with five workers in 2010. Demand has been steady, and the shop now employs 22 women. With her sewing business flourishing, Botaliyeva found herself contemplating the empty plot of land adjacent to her shop. Her adult son proposed to open a carwash business as it’s always been his dream. Situated in a prime location in a high-trafficked area of Tokmok, located on the outskirts of the capital, Botaliyeva and her husband recognized the potential.

Workers at Gulbaira Botaliyeva's carwash shop.

Workers at Gulbaira Botaliyeva's carwash shop.

Having seen Kyrgyz Investment and Credit Bank (KICB)’s advertisements promoting its low interest rates, Botaliyeva decided to speak with a loan officer. “The application process was easy and quick,” she recalls. Within a week of submitting her application, Botaliyeva received the 1 million KGS ($ 11,272) loan from KICB. With the new venture in place, Botaliyeva expanded her workforce by hiring an additional six employees for the carwash. Her son named the business “Squid,” because of the animal’s association with water.

With just one more year remaining to fully repay the loan, Botaliyeva plans to seek additional financing to expand the sewing business to the second floor of the carwash. “We took a significant loan at our risk, but we were able to use it wisely and effectively,” says Botaliyeva. “I'm very thankful to these financial institutions for affording us such life-changing opportunities.”

Opening up pathways out of poverty

IFC invested in Bailyk, Elet-Capital, and KICB through the Base of the Pyramid platform, which is supported by the blended finance and local currency facilities of the International Development Association’s Private Sector Window. The Base of the Pyramid platform, which was originally launched as part of IFC’s COVID-19 pandemic response, provides capital to financial services providers who serve small businesses, informal enterprises, and low-income households, addressing the financial needs of those historically excluded from the formal banking sector.

The advisory project was supported by the Women Entrepreneurs Finance Initiative (We-Fi), which created awareness in the market through studies on women-owned MSMEs, knowledge-sharing activities, and assessment of internal capabilities of financial institutions focused on serving women entrepreneurs.

Job creation through SMEs paves a direct pathway out of poverty, according to Wiebke Schloemer, IFC’s director for Türkiye and Central Asia. “SMEs are crucial to driving growth and innovation in developing economies such as the Kyrgyz Republic. They create jobs and increase purchasing power, which fuels economic development. We should rethink how money moves into the poorest countries. Supporting small businesses not only helps them grow but also fights poverty in struggling nations.”

For Attokurova, community-wide poverty reduction is the ultimate goal, and she encourages other women to develop their own businesses. “A woman can provide other women jobs,” she says. “By doing business, women can contribute to the country’s economy.”

“A woman can provide other women jobs. By doing business, women can contribute to the country’s economy.”

Published October 2023